It doesn't matter if you are a newbie looking for an opportunity to open a shop on Shopee or an existing seller on Shopee, there is only one thing you need to pay more attention to, that is, Shopee seller fees. Shopee seller fees are charged to sellers for every successful order made. The seller fees always consist of two parts:

1. Shopee commission fee and 2. Shopee transaction fee. However, recently, Shopee make an adjustment charge ranging from 5% to 6.5% commission fee rates will take effect on April 1, 2024. Besides, you will sometimes be charged with an additional 3. Shopee service fee. Shopee announced that the updates they would make with the commission fees would further enhance the features and programs for the users, and help more sellers and buyers benefit from e-commerce in the long run.

Here's a recap of our new and improved features and programs:

a.Fast Shipping Program

b.Shopee Video

c.Chat response rate chat filters

d.Multiple voucher usage

1. Commission Fee

Effective April 1, 2024, Shopee will update its commission fee across all local sellers.

Note: Shopee will be providing you with additional support through extra platform vouchers for April.

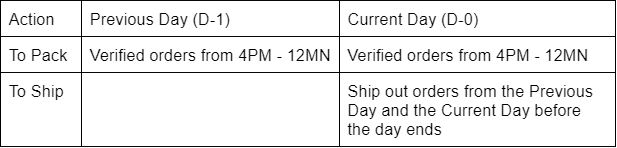

Additionally, if you are a locally fulfilled seller, you can enjoy a 1% discount on commission fee if you meet the Fast Shipping Program fulfillment criteria below:

a. Must be locally fulfilled.

b. Ship out orders created from previous day (D-1) until 4pm of current day (D0) within the same day (D0).

Note:

a.Ensure no fulfillment penalties(NFR/LSR) for the last 30 days

b.Your eligibility to receive the benefits will be assessed every 15th of the month, based on your performance in the last 30 days.

c.Want to learn more about the Fast shipping program here

Commission Fee Rates:

Shopee Mall Commission Fee Rates

Shopee Marketplace Commission Fee Rates

Sample for how to compute the Commission Fees:

2. BIR 1% Withholding Tax (starting from April 1, 2024):

In accordance with BIR Revenue Regulation No. 16-2023, as a local seller, you will be subject to 1% Creditable Withholding Tax of 50% of your gross remittances (i.e. 0.5% of your gross sales) if you meet the criteria below:

a. Your gross remittances from Shopee in previous year or for the current year exceeded ₱500,000

b. You submit a sworn declaration (SD) that your total gross remittances for all online business channels exceeds ₱500,000

c. You fail to submit a sworn declaration (SD) of your total gross remittances

Sample computation of income after implementation of BIR Withholding Tax:

To help illustrate your income after Seller Fees (Transaction Fee, Commission Fee, Service fee (if applicable)) and BIR Withholding Tax deduction, here is a sample calculation:

a. First calculate the buyer payment

b. Calculate for Transaction Fee

Transaction Fee (+ VAT) Sample Calculation Using 2.24%

c. Calculate for Commission Fee

Sample used here is 4.5% commission fee rate

d. Calculate for Seller Program Service Fee

Sample using Free Shipping Special Program

e. Calculate for the BIR Withholding Tax

⚠️ Note

The calculation of withholding tax is based on the your shop / tax entity's VAT Registration Type (VAT Registered or Non-VAT Registered), which is indicated in the BIR Certificate of Registration.

f. Final computation of Seller Income

Income after deducting Transaction, Commission, Service Fees and BIR Withholding Tax

Sellers need to consider the fees when pricing their products to ensure they can still profit while using Shopee as a selling platform.

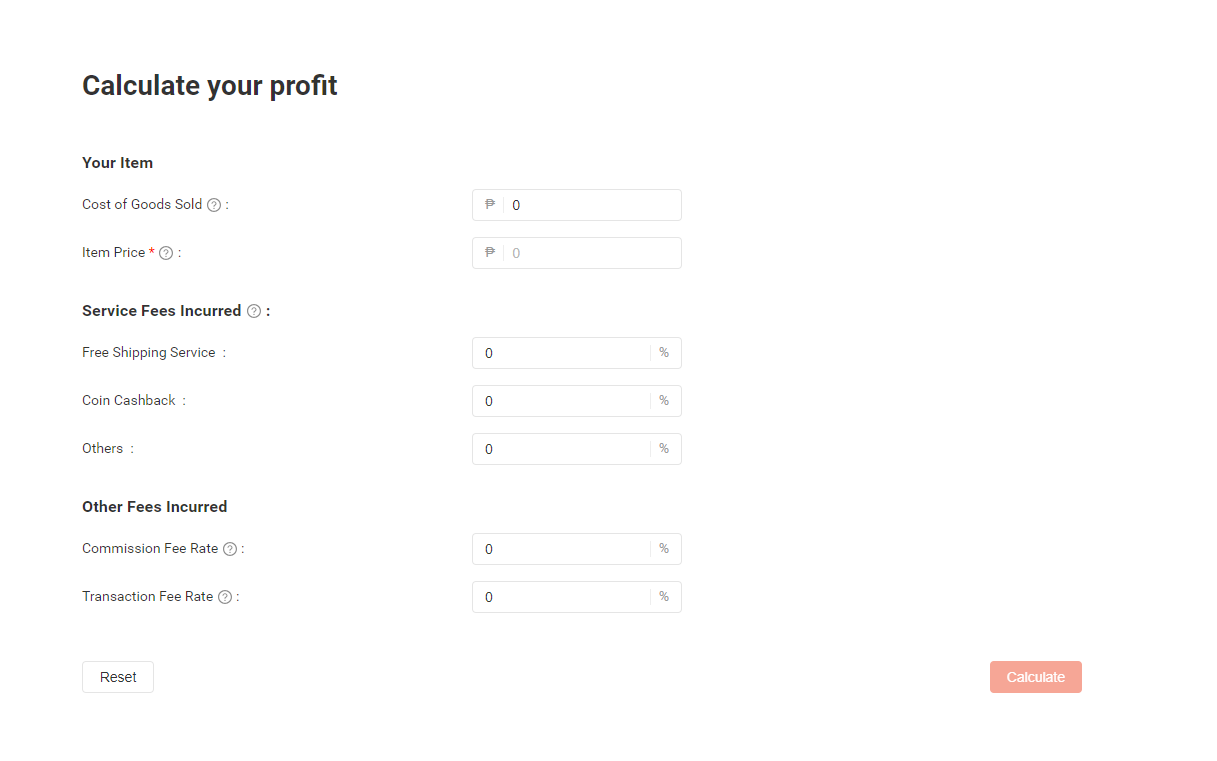

You can use the Pricing Calculator to help you estimate the price of your products competitively. Learn how to use the price calculator here.