Malaysia to Implement Expanded Sales and Service Tax (SST) in July 2025

Erra 19 Jun 2025 06:04ENCopy link & title

In this article, we break down the SST expansion, highlight what’s new, and explain what it means for Malaysian businesses.

Why is Malaysia expanding SST?

The government wants to collect more tax money (they’re aiming for RM5 billion in 2025). To do this, they’re making more goods and services taxable under SST, including things that weren’t taxed before, especially business services and digital services.

At the same time, this move helps plug gaps in the current tax system, where some companies or services weren’t paying their fair share. Instead of going back to the old GST system, Malaysia is keeping SST but making it broader and more efficient.

What’s Changing on 1 July 2025?

1. Higher Sales Tax for Non-Essential Goods

The government is updating sales tax rates to better reflect the difference between basic and luxury items:

-

0% tax stays the same for essentials like rice, milk, books, and medicine.

-

5% tax will now apply to some non-essential goods that used to be tax-free, like salmon, avocados, and bicycles.

-

10% tax targets luxury items like watches, cruise ships, designer handbags, and camera lenses.

2. Broader Service Tax Coverage

The service tax is being expanded to include more types of services, especially those used in business and digital sectors.

Now taxable services include:

-

Rental & Leasing (8%): Covers things like renting equipment or warehouse space.

-

Construction Services (6%): Includes work on warehouses, offices, and logistics centers.

-

Financial Services (8%): Affects things like buy-now-pay-later (BNPL), trade finance, or credit services from non-banks.

-

Healthcare & Wellness (6–8%): Includes services like health screenings, spa treatments, massage therapy, and slimming centers.

-

Education (6%): Only applies to private schools that charge over RM60,000 a year or serve international students.

Transitional Rules: What Happens to Existing Contracts?

For Sales Tax:

-

If you send out an invoice before 1 July, the old tax rate applies, even if the product is delivered later.

-

But if the product is used or sold after 1 July, the new tax rate applies, regardless of when it was invoiced.

For Service Tax:

-

If a service is completed before 1 July, it’s not taxed, even if you invoice it later.

-

If a service starts before and ends after 1 July, only the part done after 1 July will be taxed.

What Sellers Should Do Next (And Why)

|

What to Do |

Why It’s Important |

|

Recheck your product HS codes |

HS (Harmonized System) codes decide how much sales tax you pay. Using the wrong code can mean overpaying or underpaying tax which leads to problems. |

|

Review your contracts with suppliers and service providers |

Make sure the contracts reflect the new SST rules so you can plan for any cost changes or tax obligations. |

|

Update your invoicing and billing systems |

Your system must know when to apply old vs. new tax rates, especially during the transition period starting 1 July 2025. |

|

Let customers know about any price changes |

Be transparent to avoid being accused of price gouging, which is illegal under Malaysia’s anti-profiteering laws. |

|

Check if you qualify for B2B (business-to-business) exemptions |

If your customers are also businesses, you might not need to charge them service tax, this could help you stay competitive and reduce tax costs. |

Stay Ahead of SST Changes with the Right Tools

The SST expansion taking effect on 1 July 2025 brings new tax obligations that directly affect how e-commerce sellers handle pricing, invoicing, and reporting. To comply, sellers need better control over their financial data and sales records across platforms like Shopee, Lazada, and TikTok Shop.

BigSeller offers several functions that directly support these tasks:

-

Recharge Invoices for Tax Filing: BigSeller VIP users can customise and download official invoices that include business names, tax numbers, and addresses, important for keeping SST records in order.

-

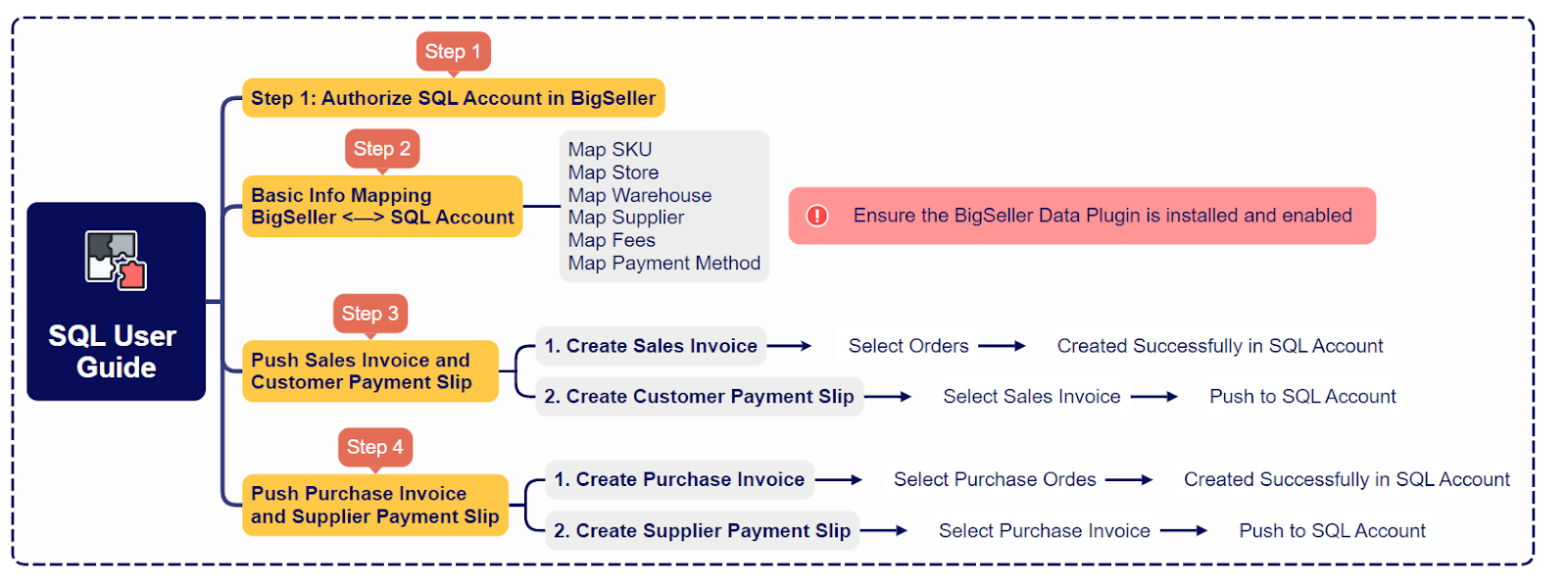

Integration with SQL Accounting Software: After processing orders in BigSeller, sellers can push data to SQL Account to auto-generate sales and purchase invoices, synchronise inventory, and map payment methods. This streamlines SST reporting and reduces manual entry errors.

-

Financial and Sales Reporting: With tools like Profit Analysis, Invoicing Reports, and Store-Level Order Analysis, sellers can monitor margins, reconcile payments, and identify potential pricing issues before they trigger compliance risks under the Price Control and Anti-Profiteering Regulations.

-

Reconciliation and Audit Preparedness: BigSeller also supports payment reconciliation and tracks operational activity by employees, which helps maintain proper documentation in case of tax audits.

As SST rules evolve, sellers who maintain accurate data and automate their invoicing processes will be better equipped to comply and avoid unnecessary penalties. BigSeller’s ecosystem supports this operational readiness, especially for those managing high order volumes across multiple channels.

Try BigSeller for FREE today and get a 7-day VIP trial to explore the features.

Don’t miss out, follow our WhatsApp channel for the latest e-commerce tips and more updates!